1. A new macro-financial framework that is more demanding… but promising

The Government chooses a growth model driven by investment and no longer only by consumption. The large “Growth Poles” (Renewable Energies, Waste-to-Wealth, Blue Economy, Creative Industries) will channel 30 bn MUR of private and public investments over three years . This orientation confirms that commercial and residential real-estate will be called upon to accompany these sectoral hubs (port logistics, business parks, sustainable-tourism residences, etc.), in the manner of international clusters.

2. Land and town-planning: the triptych “digital planning, reallocation, transparency”

Key takeaway: the real-estate value chain will digitalise from land prospecting to authorisations. Actors able to master geo-spatial and ESG data will gain a competitive edge.

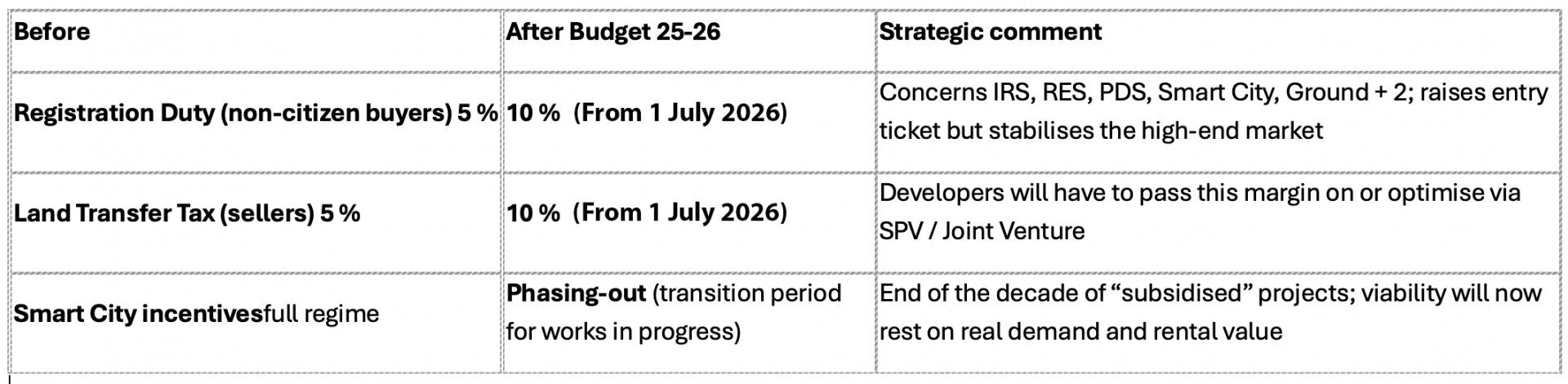

3. Real-estate taxation: the turn towards “pay-as-you-grow”

👉 Message to foreign investors: Mauritian real estate is moving from a “fiscally assisted” environment to a more mature market where value-creation will prevail over tax arbitration.

4. Modernised institutions serving deal flow

- EDB revamped: faster one-stop shop, new sectoral incentive schemes and relaunch of the “Innovative Mauritius” brand .

- Simplified Wealth-Management & Family-Office licences: strengthens the ecosystem for UHNWIs wishing to structure real-estate portfolios and succession from the island .

- Heritage Stewardship Scheme: PPP opportunities to restore and operate theatres, museums, listed buildings – niches for high-end hotel or event conversions .

5. Housing policy: a two-speed residential market

The speech acknowledges 8 000 social-housing units under way but insufficient; a Housing Policy Roadmap is announced to catch up the delay and revise eligibility thresholds .

Implication for “Build-to-Rent” investors: potential niche in the middle-income segment, notably via partnerships with the NHDC (National Housing Development Company).

ESG synergies: social inclusion and flood-control (10 NHDC sites integrated into the National Flood Management Programme) will enhance projects compliant with anti-cyclonic and low-carbon standards.

6. Infrastructure & growth poles: value-drivers for land

The 128 bn MUR five-year programme (M4 motorway, Ring Road 2, enlarged cruise port, Rivière-des-Anguilles dam) will create new premium accessibility zones around future bus-stations, interchanges and logistics terminals .

Anticipate the north-east corridor (Forbach → Bel Air) for “commuter-belt” residential developments.

Port Louis Cruise & Freeport: “serviced-apartment” and grade-A warehouse products upstream in the tourist chain.

7. Synthesis of risks & opportunities

8. Forward view

This budget shifts Mauritius from the status of “fiscal gigafactory” to that of a “regulated and green investment destination.” For capital-builders, alpha will no longer lie in tax advantage but in mastering

- regulatory flows (permits, ESG, AI compliance),

- the local value chain (training, low-carbon supply-chain) and

- the user experience (live-work-play products, sustainable hospitality).

Investing in Mauritius in 2025-2028 will therefore be a game of execution, not just arbitration. The budget lays the rails; it is up to sophisticated developers and investors to run the train.